Top 10 Bookkeeping Tips for 2019

Unless you’re an accountant, chances are organizing your books isn’t your idea of a fun afternoon. However, keeping your books in order all year can save a lot of hassle when it comes to tax season. Here are some tips to keep your bookkeeping simple, organized and understandable.

Personal finances should be kept separate

Keeping your personal expenses separate from your business’s will help you avoid a lot of confusion and will be a huge time saver when it comes time to do your taxes. You won’t have to sift through documents trying to decipher what expenses are business vs personal because they’ll already be organized.

Create a chart of accounts that is simple and functional

For those who don’t know, a chart of accounts can be thought of as a comprehensive file for your financials; it lists your company’s account names and numbers. This chart is considered the backbone of your bookkeeping. It reflects the entire operation. There are typically five main categories of accounts: assets, liabilities, revenue, expenses, and owner’s equity

Here are some main things to remember when creating a chart of accounts: 1. Do not over-categorize. Only set up accounts you NEED. 2. Rather than creating accounts with names, such as vendor or customer names, create them as the type of transaction. 3. Do not forget to double check the account type. If it is wrong this will cause errors in the financial statement.

Go digital

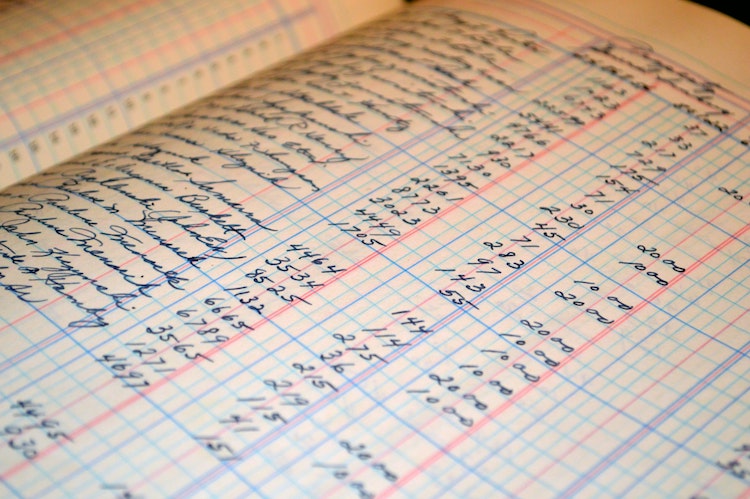

Ditch the paperwork and go digital for your payroll. This way you’re storing all necessary info in one, convenient spot, the cloud. It makes payroll a breeze, keeps bookkeeping simple and saves managers and owners a lot of time. So, make the switch and thank us later.

Consistently reconcile your bank statements

Whether you’re using digital software or doing it by hand, reconciling your statements regularly will save you a lot of headache in the long run. Don’t be that person that puts it off for months because it is very easy to make mistakes when recording expenses. This will affect your bottom line and will be a lot harder to fix than if you do it consistently.

Record financial data on a monthly basis

Ultimately, this will help you view and build trends and evaluate the trajectory of growth. You can track monthly based on category of income and this will show you where your business is growing, decreasing and areas for potential growth. It’s important to do this as well as annually as it will show small fluctuations and you will see more accurate trends.

When reconciling, fix mistakes right away

It is a mistake to not reconcile monthly but an even bigger mistake to not fix errors right away when you notice discrepancies. Even if it is $0.01 between the books and what’s in the bank fix it right away or this error will carry over to other months and be a lot harder to solve later.

Keep meticulous inventory records

This is a small task but very important and often overlooked. It will be beneficial in more ways than one. It’ll help you discover customer shopping trends which ensure efficient buying later on but will also prevent employee theft and merchandise misplacement.

When documenting expenses, treat checks like cash

If you put off documenting each check you write, they will add up quickly and be a nightmare adding in later. Losing track of checks can cause serious issues in your books so it’s best to document them well.

Make a plan for major expenses, yes, even taxes

By simply budgeting for major expenses, like taxes, inventory, repairs, and maintenance will save you a lot of stress when these expenses appear. Don’t pretend like these things won’t happen and your accountant can help you anticipate an accurate percentage of your revenue to set aside for taxes. Plan to spend the money in the future and set aside a contingency. This way when the expenses appear your business won’t take the hit for an unexpected expense.

Don’t wait until the end of the year to visit your accountant

By keeping in touch with your accountant will make sure that any bookkeeping issues are caught and taken care of. Although accounting software can enable almost anyone to keep track of their business finances, having a good accountant is still necessary as they can give opinions beyond setting up your accounting system. They will help you manage your business from the beginning; with everything from making an effective business structure, to payroll and, most importantly, taxes.

Bookkeeping can be a headache, but it doesn’t have to be. Follow these tips from the beginning of 2019 until the end and we promise tax season will be a lot easier. Give Yeater & Associates in Greeley a call today to get started!